federal estate tax exemption 2022

Your estate wouldnt be subject to the federal estate tax at all if its worth 12059 million or less and you were to die in 2022. Lower Estate Tax Exemption.

Estate Tax Exemptions 2022 Fafinski Mark Johnson P A

12 rows For 2022 the personal federal estate tax exemption amount is 1206 million it was 117.

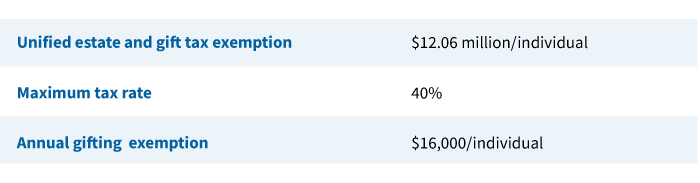

. The current federal estate tax exemption amount is 11700000 per person. The annual inflation adjustment for federal gift estate and generation-skipping tax exemption increased from 117 million in 2021 to 12060000 million in 2022. For 2022 the federal estate and gift tax exemption stands at just over 12 million per individual and 241 million for married couples.

In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. The first 1206 million of your estate is therefore exempt from taxation. So how does this affect you.

Up from 117 million for 2021 the 2022 exemption amount will be 1206 million. Legislation currently pending in Congress could change that limit if it becomes law. If you have an estate of 10000000 and decide to keep it in your possession past the end of the year 5000000 of your assets will be subject to estate tax.

From Fisher Investments 40 years managing money and helping thousands of families. The state does however provide an. The federal estate tax exemption provides that an estate with a value below the exemption amount can be passed on tax-free.

The IRS recently announced inflation adjustments for the 2022 tax year with Estate Tax rates and Trust tax. Estate Tax Exemption goes up for 2022 For year 2022 the IRS has announced that the per-person exemption is now 1206 million up from 117 million in 2021. The federal estate tax limit will rise from 117 million in 2021 to 1206 million in 2022.

On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. Since 2018 federal tax assessment on estates above 117 million indexed for inflation every year will default back to pre-2018 exemption levels on the first day of 2026. In 2022 the federal estate tax generally applies to assets over 1206 million.

The federal estate tax limit will rise from 117 million in 2021 to 1206 million in 2022. The annual exclusion for gifts increases to 16000 for calendar year 2022 up from 15000 for calendar year 2021. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax.

The 2022 exemption is 1206 million up from 117 million in 2021. On november 10 2021 the irs announced that the 2022 transfer tax exemption amount is 12060000 10000000 base amount plus an inflation adjustment of 2060000. The exemption for gifts and property is unified which means that it includes both taxable life gifts of an individual and taxable property in the event of death.

Under current law the existing 10 million exemption would revert back to the 5 million exemption amount on January 1 2026. The estate tax is a tax on your accumulated wealth assessed by the federal government when you die. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million indexed for inflation to roughly 62 million as of January 1 2022. Trusts and Estate Tax Rates of 2022.

The federal gift tax limit will jump from 15000 in 2021 in effect since 2018 to. In 2022 the federal estate tax exemption is 12060000 for an individual or 24120000 million for a married couple. Transfer tax exemption for lifetime gifts death transfers and generation-skipping transfers.

In Maryland state estate tax limits will stay at 5 million. The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. As of early 2022 the exemption amount is 1206 million per person.

However President Trumps increase was designed to roll back in 2026 so in 2026 the exemption is very likely to roll back to about 7 million per person. New Yorks estate tax exemption threshold for 2022 is 611 million the state does not offer the benefit of portability. For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40.

12 rows For 2022 the personal federal estate tax exemption amount is 1206 million it was 117. This increase means that a married couple can shield a total of 2412 million. Your first 1206 million passes tax-free called your federal estate tax exemption.

Federal lawmakers set an estate tax exemption threshold annually. Any amount above is taxed at a hefty 40. 2022 Annual Adjustments for Tax Provisions.

8 rows there are seven federal income tax rates in 2022. Annual exclusion for gifts to noncitizen spouses 164000. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

Employers engaged in a trade or business who pay compensation. For example be. But they should still plan to save income taxes.

The current federal estate tax exemption 1206 million in 2022 means that many people arent concerned with estate tax. The federal gift tax limit will jump from 15000 in 2021 in effect since 2018 to 16000 in 2022. Estates of decedents who die during 2022 have a basic exclusion amount of 12060000 up from a total of 11700000 for estates of decedents who died in 2021.

24 rows on november 10 2021 the irs announced that the 2022 transfer tax exemption amount is. Up from 159000 in 2021. The federal estate tax law and the generations skipping tax GST exemptions are complex and ever-changing and you may need to update your estate plan annually to adapt.

For married couples the exclusion is now 24120000 million. Get information on how the estate tax may apply to your taxable estate at your death. 11700000 in 2021 and 12060000 in 2022.

Each spouse gets an exemption so married couples can pass 2412. Provided that the total taxable value of ones estate comes in under that level it will not be subject to tax. For people who pass away in 2022 the exemption amount will be 1206 million its 117 million for 2021.

1 You can give up to those amounts over your lifetime without paying federal income tax. As of January 1 2022 that will be cut in half. Up from 13050 in 2021.

The tax starts at 18 on your first taxable 10000 and climbs to 40 on taxable assets over 1 million. The tax rate applicable to transfers above the exemption is currently 40. You can find all the details on tax rates in the Revenue Procedure 2021-45.

Employers Quarterly Federal Tax Return Form W-2. At death a surviving spouses estate will owe estate taxes on the net value that exceeds the. Threshold for top federal income tax bracket 37 same as 2021 and the 38 tax on net investment income for estates and trusts over 13450.

For a married couple that comes to a combined exemption of 2412 million. For couples the exclusion is now 2412 million. Put simply this will only affect you if the total value of your estate exceeds the tax exemption amount.

What is the estate tax exemption for 2022.

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

New Estate And Gift Tax Laws For 2022 Lion S Wealth Management

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Estate Taxes Under Biden Administration May See Changes

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Four Estate Planning Ideas For 2022 Putnam Wealth Management

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Warshaw Burstein Llp 2022 Trust And Estates Updates

Make Note Of These Estate And Gift Tax Exemption Amounts For 2022 Preservation Family Wealth Protection Planning

Historical Estate Tax Exemption Amounts And Tax Rates 2022

New Estate And Gift Tax Laws For 2022 Youtube

10 Ways To Be Tax Exempt Howstuffworks

What Is A Homestead Exemption And How Does It Work Lendingtree

Accounting For S Corp Upcounsel 2019 Accounting Capital Account Tax Money

Where Not To Die In 2022 The Greediest Death Tax States

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half